Alejandro Casado

Research Economist

Banco de España

Financial Stability and Macroprudential Policy Department

Biography

I am a Research Economist currently working at the Financial Stability and Macroprudential Policy Department of the Banco de España.

My field of expertise is empirical finance with a special interest in financial intermediation.

Interests

- Bank Specialization

- Credit Risk

- Credit Supply Shocks

- Bank Private Information

- Deposit and Lending Competition

- Monetary Policy

- Debt Contracting

Education

- Ph.D. in Finance (2019-2023) Universidad Carlos III de Madrid

- Research Visit (2021-2023) Banco de España

- MS in Business and Finance (Research Master) (2017-2019) Universidad Carlos III de Madrid

- BA in Economics (2012-2016) Universidad Carlos III de Madrid

Working Papers

Estimating the Impact of Loan Supply Shocks

With Nittai K. Bergman, Rajkamal Iyer, and Itay Saporta-Eksten

Using a simple model of firm borrowing with standard ingredients, we show that commonly used empirical approaches in the literature do not recover the impact of credit supply shocks on loan-level lending, on total firm-level borrowing or on real outcomes. We propose new estimators that recover these effects. We apply our methodology to the 2011 credit crisis in Spain and show that it implies significantly smaller effects of loan supply shocks than those generated by current empirical approaches.

Local Lending Specialization and Monetary Policy

With David Martinez-Miera

Revise & Resubmit, Review of Finance

Award: Best Doctoral Paper awarded at the FMARC Conference (2023)

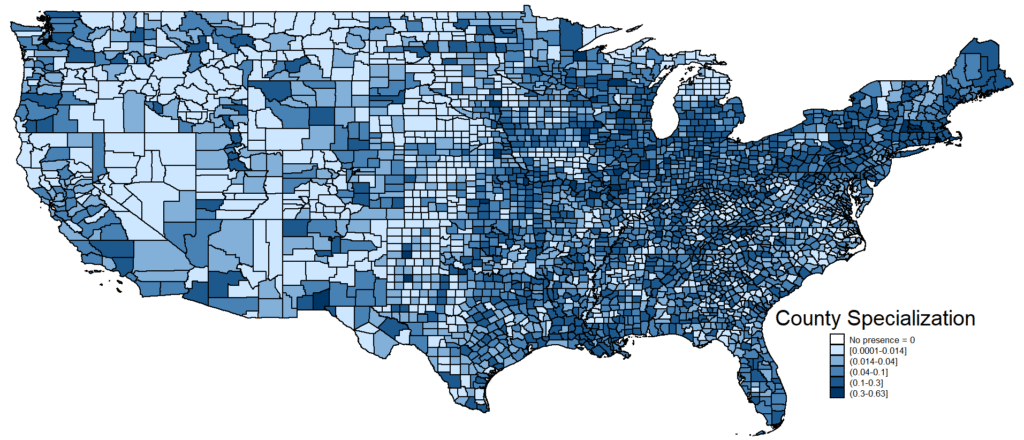

We provide evidence that bank loan supply reactions to monetary policy changes are market-specific, emphasizing the importance of banks’ local specialization. We analyze the U.S. mortgage market and find that when monetary policy eases, banks increase new mortgage lending growth more in markets in which they are geographically specialized relative to other markets and banks. This holds after controlling for local lending opportunities and (unobservable) bank differences. Further empirical findings, supported by a simple model, suggest that banks face market-specific differences in lending advantages, related to market-specific information, leading them to exhibit different reactions to monetary policy changes. We document the aggregate effects of this geographical specialization channel both at the county level on mortgage supply and house price growth, as well as at the bank level on average specialization growth. Our study underscores the relevance of banks’ local specialization in shaping the transmission of monetary policy.

Banks' Specialization and Private Information

With David Martinez-Miera

Award: Honorable Mention in the Antonio Dionis Soler Research Prizes, awarded by the Instituto Español de Analistas (2025)

Press Coverage: El Confidencial «¿Sobran los bancos pequeños? Esto es lo que dicen seis años de crédito a pymes»

We document the geographical and sectoral specialization of banks’ lending activities using comprehensive data on the universe of loans to corporate borrowers in Spain. Our analysis highlights how specific sources of specialization are more relevant for evaluating different types of borrowers. Specifically, loans to micro and small firms exhibit reduced probabilities of non-performance in geographical markets where banks specialize, whereas loans to medium and large firms experience lower non-performance in sectors in which banks specialize. Crucially, we provide the first evidence of a direct link between bank specialization and enhanced banks’ private information by leveraging confidential data on banks’ private risk assessments reported to regulators. We corroborate our findings by analyzing the relevance of relationship lending, a well-established proxy for firm-specific private information.

Digitalization and Credit Markets: Evidence from eInvoicing

Revise & Resubmit, Review of Finance, special issue on «The Future of Payments»

Electronic invoicing (eInvoicing) provides verifiable, digital, structured, real-time transactional records that firms can use when seeking financing. We study its impact on credit markets using granular loan-level data and the introduction of mandatory eInvoicing in Spain’s Basque Country. Our preliminary results show that this digitalization process expands firms’ use of invoice-based credit. The improved hard information negatively affects the quality of banks’ information (measured as predictive quality of their PD estimations). We also find some evidence in line with the information gap (difference in predictive quality) between incumbent and outside banks narrowing. Our project aims to contribute to understanding the digitalization of credit markets.

Firms’ Financial Reporting Quality and Banks’ Shock Transmission

With Nadia Lavín, David Martinez-Miera, Antonio Moreta, and Irene Pablos

We highlight the role of firms’ financial reporting quality in the transmission of bank credit supply shocks to the economy. We exploit a large dataset of all corporate loans in Spain over 2009-2019 which allows us to identify firm-year bank credit supply shocks by accounting for time-varying firm heterogeneity in loan demand. We find that after an adverse bank credit supply shock, firms with lower financial reporting quality experience a sharper contraction in bank credit compared to firms with higher financial reporting quality. Further, such firms are unable to fully substitute the additional drop in bank credit with alternative financing sources, resulting in a higher decrease in their investment and asset growth. These results are amplified for financially constrained firms. Our findings suggest that financial reporting quality is related to lower information frictions between firms and capital providers.

Policy Writing

2023-2025

Autumn 2023, Spring 2024, Autumn 2024, Spring 2025, Autumn 2025

October 2017

Results of PIRLS for Students in Bilingual Studies

Alejandro Casado, María Luengo, and Almudena Sevilla

September 2016

Desajuste en Competencias Entre la Oferta y la Demanda de Trabajo en España

Alejandro Casado and Sergio Puente

Teaching

Average instructor rating: 4.77/5

Fall Term 2021

Bank Management

Instructor. In-person: Teaching Survey: 4.96/5

Diploma: Top 5 teaching assistant award for 2021/2022, certified by the Department Head.

Fall Term 2020

Bank Management

Instructor. On-line (90 students): Teaching Survey: 5/5 and 4.79/5.

Diploma: Top 5 teaching assistant award for 2020/2021, certified by the Department Head.

Fall Term 2019

Bank Management

Instructor. In-person: Teaching Survey: 4.77/5 and 4.48/5.

Diploma: Top 5 teaching assistant award for 2019/2020, certified by the Department Head.

Spring Term 2019

Financial Management

Teaching Assistant. In-person: Teaching Survey: 4.71/5 and 4.67/5.

Diploma: Top 5 teaching assistant award for 2018/2019, certified by the Department Head.

Anonymous Student Testimonials

Get In Touch!

Address